Enjoy Peace of Mind When You Drive With Grab

As part of our continued effort to reduce the burden of e-hailing regulations for our driver-partners, we are happy to announce the launch of the new Grab Daily E-hailing Insurance. This innovative product will ensure you are covered for 24 hours when you are online and driving with Grab.

Section 1: What is Grab Daily E-hailing Insurance?

Grab has partnered with selected insurance companies to offer an innovative and flexible product that is suitable for our driver-partners, for those of you who rely on Grab as an additional source of income.

With this product:

- You ONLY pay for insurance when you come online. Insurance is valid for 24 hours.

- All your Grab rides during this period will be covered by the e-hailing insurance.

- All you need to do is to opt-in to the Grab Daily e-hailing Insurance from the app.

- No need to purchase annual e-hailing insurance.

Section 2: How do I get Grab Daily E-hailing Insurance?

Step 1: Opt-in for Grab Daily E-hailing Insurance in July*

*Note: We will let you know when you can opt-in via the app. For now, just ensure your Motor Insurance provider is on Grab’s panel of insurers. Refer to Section 3.

*Note: If your Motor Insurance provider does not offer e-hailing insurance, you will not be able to drive from 12 July 2019 onwards.

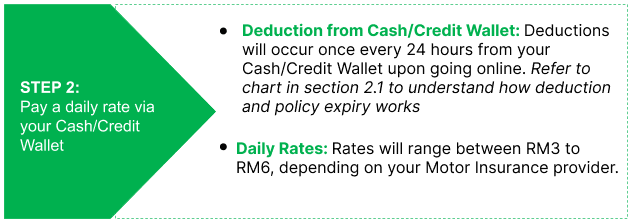

Step 2: Pay for Grab Daily E-hailing Insurance

2.1 Deduction and Policy Expiration

Daily premium deduction:

- The deductions will only occur when you come online for transport jobs.

- Daily premiums are deducted from cash or credit wallet depending on driver’s wallet balance.

- Deductions are first made through the cash wallet if the balance is sufficient to cover the daily premium.

- If the cash wallet balance is insufficient, deductions are made through the credit wallet.

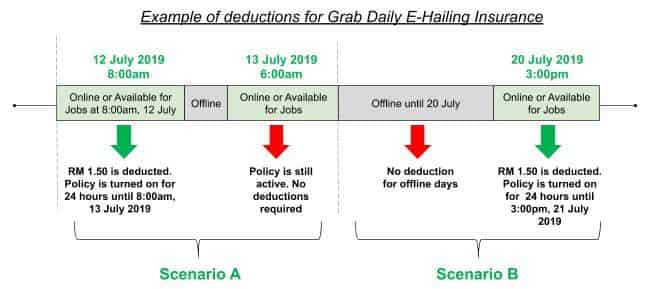

Scenario A: Daily Insurance is activated upon deduction of daily premium. Each deduction covers you for 24 hours.

Example: After deduction of premium, you are insured to drive any time during the 24 hour insurance period. This applies even when you go offline and online again. If you come online at 8am on 12 July 2019, you will be covered until 8am on 13 July 2019.

Scenario B: You do not have to pay for days that you do not go online.

Section 3: Pricing, Coverage details & Claims for Grab Daily e-hailing Insurance

Coverage Details

Coverage details will differ for each insurer. Refer to the below for more information.

Claims

You will only be able to file claims if you get into an accident while you are completing a Grab ride or actively available* on Grab.

*Actively Available is defined as: driver-partners being online and ready to receive jobs by keeping minimum credit wallet balance (RM10) at all times.

To file for a claim, you will need to contact your insurer.

Important note:

Due to the recent service tax changes implemented by the Government of Malaysia effective from 1 March 2024, rising from 6% to 8%, most of our GDI Insurers will be adjusting their Daily E-hailing Insurance net pricing.

Daily Rate: RM3.00 [RM4.00 effective from 10 January 2024]

Coverage Details :-

- Loss or Damage to your own Vehicle

- Liability to Third Parties

- Personal Accidents Cover for Authorised E-hailing Driver up to RM10,000

- Unlimited Legal Liability to Fare Paying Passengers – Unlimited

- Legal Liability of Fare Paying Passengers for Negligent Acts – Unlimited

Daily Rate: RM5.10 (Starting 1 March)

Coverage Details :-

- Loss or Damage to your own Vehicle

- Liability to Third Parties

- Personal Accidents Cover for Authorised E-hailing Driver up to RM10,000

- Unlimited Legal Liability to Fare Paying Passengers – Unlimited

- Legal Liability of Fare Paying Passengers for Negligent Acts – Unlimited

Daily Rate: RM3.06 [Effective 1 March]

Coverage Details :-

- Loss or Damage to your own Vehicle

- Liability to Third Parties

- Personal Accidents Cover for Authorised E-hailing Driver up to RM20,000

- Unlimited Legal Liability to Fare Paying Passengers – Unlimited

- Legal Liability of Fare Paying Passengers for Negligent Acts – Unlimited

Daily Rate: RM5.00

Coverage Details :-

- Loss or Damage to your own Vehicle

- Liability to Third Parties

- Personal Accidents Cover for Authorised E-hailing Driver up to RM15,000

- Unlimited Legal Liability to Fare Paying Passengers – Unlimited

- Legal Liability of Fare Paying Passengers for Negligent Acts – Unlimited

Daily Rate: RM3.06 (Starting 1 March),RM4.86 (1 April – 30 September), RM 6.11 (Starting 1 October onwards)

Coverage Details :-

- Loss or Damage to your own Vehicle

- Liability to Third Parties

- Personal Accidents Cover for Authorised E-hailing Driver up to RM25,000

- Unlimited Legal Liability to Fare Paying Passengers – Unlimited

- Legal Liability of Fare Paying Passengers for Negligent Acts – Unlimited

Daily Rate: RM3.06 (Starting 1 March),RM4.86 (1 April – 30 September), RM 6.11 (Starting 1 October onwards)

Coverage Details :-

- Loss or Damage to your own Vehicle

- Liability to Third Parties

- Personal Accidents Cover for Authorised E-hailing Driver up to RM10,000

- Unlimited Legal Liability to Fare Paying Passengers – Unlimited

- Legal Liability of Fare Paying Passengers for Negligent Acts – Unlimited

Daily Rate: RM3.97 (Starting 1 March)

Coverage Details :-

- Loss or Damage to your own Vehicle

- Liability to Third Parties

- Personal Accidents Cover for Authorised E-hailing Driver up to RM10,000

- Unlimited Legal Liability to Fare Paying Passengers – Unlimited

- Legal Liability of Fare Paying Passengers for Negligent Acts – Unlimited

Daily Rate: RM3.40 (Starting 1 March)

Coverage Details :-

-

- Loss or Damage to your own Vehicle

- Liability to Third Parties

- Personal Accidents Cover for Authorised E-hailing Driver up to RM10,000

- Unlimited Legal Liability to Fare Paying Passengers – Unlimited

- Legal Liability of Fare Paying Passengers for Negligent Acts – Unlimited

a

Daily Rate: RM5.62 (Starting 1 March)

Coverage Details :-

- Loss or Damage to your own Vehicle

- Liability to Third Parties

- Personal Accidents Cover for Authorised E-hailing Driver up to RM50,000

- Unlimited Legal Liability to Fare Paying Passengers – Unlimited

- Legal Liability of Fare Paying Passengers for Negligent Acts – Unlimited

Please be informed that AXA Affin General Insurance Berhad and MPI Generali Insurans Berhad will integrate and operate under one single entity – Generali Insurance Malaysia Berhad starting 1 April 2023.

Daily Rate: RM3.26 (Starting 1 March)

Coverage Details :-

- Loss or Damage to your own Vehicle

- Liability to Third Parties

- Personal Accidents Cover for Authorised E-hailing Driver up to RM10,000

- Unlimited Legal Liability to Fare Paying Passengers – Unlimited

- Legal Liability of Fare Paying Passengers for Negligent Acts – Unlimited

If you are not on one of the panel insurers above or have already purchased an annual insurance, click here to find out your next steps.

Frequently Asked Questions

General FAQs on Grab Daily E-hailing Insurance

How do I opt-in for Grab Daily E-hailing Insurance?

Ensure you get your PSV licence first and your Insurance provider is on Grab’s panel. Then, wait for communications from Grab to start opting in via the app.

Do I need to provide Grab any documents/Insurance Note if I want to opt-in for Grab Daily E-hailing Insurance?

No. You just need to opt-in via the Grab app.

Which Insurers are eligible for Grab Daily E-hailing Insurance?

You may refer to section 3 for the list of Insurers.

When can I start opting-in for Grab Daily E-hailing Insurance?

You can start opt-ing in from July 2019 via the Grab app. We will send out further communications on the specific date soon!

What if my Insurer is not within Grab’s panel?

If your Insurer is not within Grab’s panel but offers annual e-hailing insurance, you can purchase this annual policy and inform us via an updated insurance cover note via Grab driver app.

If you prefer to opt-in for Grab Daily E-hailing Insurance, you will need to cancel your existing Motor Insurance policy and convert to one of the panel Insurers through the links below:

Chubb

Choose peace of mind while you’re on the go, safeguard yourself and your car with Chubb’s motor insurance now!

Tokio Marine

Get insured with Tokio Marine, the winner of the 2019/20 Malaysian Motor Insurance Award and receive 10% rebate on your premium. Click here to begin.

Allianz

Allianz Motor Comprehensive Insurance provides your vehicle with all the necessary coverage to ensure that it is always protected. Click here to know more.

Etiqa

Enjoy 10% rebate when you renew your car insurance online. Get covered instantly with 24/7 roadside assistance and free 200km free towing. Click here.

Berjaya Sompo

SOMPO Motor is a Zero Excess Plan with Agreed Value. E-hailing add on from 65 cents per day and enjoy 10% rebate when you renew online. Quote Now!

MSIG

Protect yourself, your customers and your car with MSIG E-Hail E-Zee. Click here.

Kurnia

Get smarter protection and essential coverage from the widest network available to you. Click here.

AmAssurance

Hassle free coverage from your trusted local partner. Click here.

With Grab Daily E-hailing Insurance, can I drive with other E-hailing Operators?

No. Grab Daily E-hailing Insurance only covers you while you are driving with Grab. You should not purchase Grab Daily E-hailing Insurance to drive for other E-hailing Operators.

What if I do not want to purchase the Grab Daily E-hailing Insurance?

You can purchase your own Annual e-hailing insurance and submit the Insurance Cover Note to Grab via your driver app. Do check with your insurer if they provide this.

I have already opted-in for Grab Daily E-hailing Insurance with my existing insurer. Can I switch to another insurer which also offers Grab Daily E-hailing Insurance?

Only Grab Panel of Insurers will offer Grab Daily E-hailing Insurance. Please ensure that you switch within Grab’s Panel of Insurers to continue purchasing daily insurance.

Deductions on Grab Daily E-hailing Insurance

How does deduction occur?

We will deduct the daily rate from your Cash/Credit Wallet once every 24 hours (only if you go online). Refer to section 2.1 for illustration.

What happens if I do not have enough Cash/Credit Wallet balance?

You can still go online but ensure you top-up immediately to avoid disruptions.

Coverage Details and Benefits

Where can I view coverage details?

Upon purchase of daily insurance, your coverage details can be viewed in the GrabInsure section in the app.

Where can I view the Terms and Conditions?

You will be able to view this in the opt-in screen.

Claims

If I purchased Grab Daily E-hailing Insurance, how do I file for claims?

If you meet with an accident, kindly contact Customer Support to obtain your insurer’s contact to file for a claim.

Annual E-hailing Insurance

What if I have already purchased an annual e-hailing Insurance?

If you have purchased an annual e-hailing insurance, please update your insurance cover note via Grab driver app.

What if I want to convert my Annual e-hailing insurance policy to Grab Daily E-hailing Insurance or vice versa.

(i) Annual to Daily

You will need to cancel your annual e-hailing insurance and update your cover note via Grab driver app. Once Grab has verified your cover note, you may opt-in for Grab Daily E-hailing insurance in the app and can continue to drive.

(ii) Daily to Annual

You will need to purchase annual e-hailing insurance and update your cover note via Grab driver app. Once Grab has verified your cover note, you will not be prompted to purchase daily insurance in the app and can continue to drive.